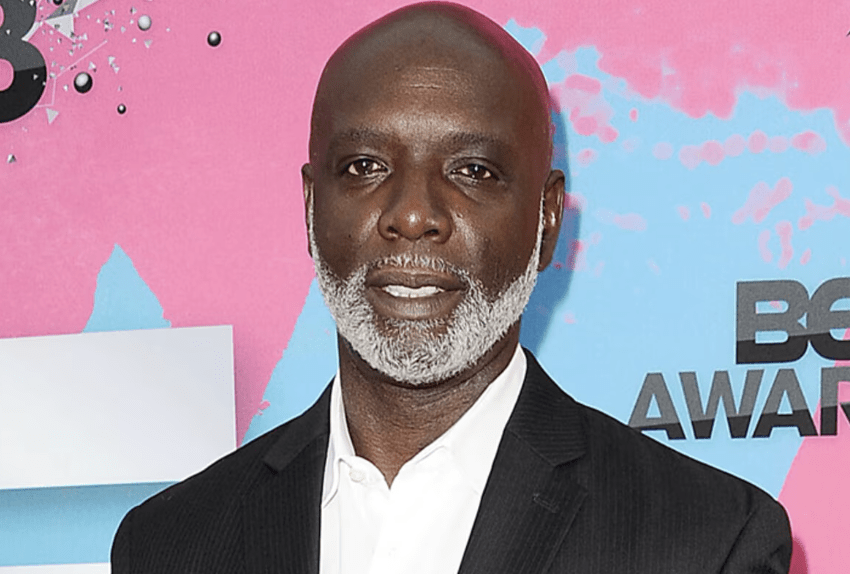

In a stark reminder of the consequences of financial missteps, Peter Thomas, a well-known entrepreneur and former reality TV star from Real Housewives of Atlanta, has begun serving an 18-month federal prison sentence for tax fraud. The 64-year-old restauranteur, once celebrated for his business acumen and charisma, now faces the repercussions of failing to pay over $2.5 million in employment taxes, leaving a cautionary tale for business owners everywhere.

A Fall from Grace

Thomas, who gained fame through his appearances on Bravo’s hit reality show alongside ex-wife Cynthia Bailey, built a reputation as a savvy businessman with ventures like Bar One in Atlanta and Miami. However, behind the glitz of his entrepreneurial success lay a web of financial mismanagement that ultimately led to his downfall. On May 21, 2025, Thomas reported to a federal prison in Florida to begin his sentence, following a guilty plea in June 2024 for one count of tax fraud.

The charges stemmed from Thomas’ failure to remit payroll taxes withheld from his employees’ wages between 2017 and 2023. These funds, intended for federal tax obligations such as Social Security and Medicare, were instead misused, leaving a staggering $2.5 million debt to the IRS. Prosecutors revealed that Thomas diverted these funds to support his lavish lifestyle and business operations, a decision that would prove catastrophic.

A Guilty Plea and a Heavy Price

Initially, Thomas faced a 15-count indictment, which included accusations of tax evasion, wire fraud, and bank fraud. However, as part of a plea deal, he admitted guilt to a single count of tax fraud, significantly reducing his potential sentence. In addition to the 18-month prison term, Thomas was ordered to pay $2.5 million in restitution to the IRS and serve three years of supervised release. U.S. District Judge Leigh Martin May, who presided over the case, emphasized the severity of Thomas’ actions, noting that his failure to comply with tax obligations undermined the integrity of the federal tax system.

Thomas’ sentencing was not without drama. In a heartfelt statement to the court, he expressed remorse, acknowledging his mistakes and attributing them to poor financial advice and his own ignorance. “I’m not a tax guy,” he reportedly told the judge, pleading for leniency. Despite his apologies, the court deemed the consequences unavoidable, given the scale of the financial misconduct.

A Warning to Entrepreneurs

From his prison cell, Thomas issued a stark warning to fellow business owners, urging them to prioritize tax compliance. “Pay your taxes!” he declared in a message shared via social media before his incarceration. He admitted to being “sloppy” with his bookkeeping, a mistake that cost him not only his freedom but also his businesses and reputation. His Atlanta-based Bar One closed in 2023, and his Charlotte location shuttered in 2024, leaving employees and creditors in the lurch.

Tax experts echo Thomas’ advice, emphasizing that payroll taxes are a non-negotiable responsibility for employers. “When you withhold taxes from employees’ paychecks, that money belongs to the government, not your business,” said IRS spokesperson Mark S. Green in a statement following Thomas’ sentencing. “Failing to remit those funds is essentially stealing from your employees and the federal government.”

The Ripple Effects

Thomas’ legal troubles have reverberated beyond his personal and professional life. His ex-wife, Cynthia Bailey, who divorced him in 2017, has remained silent on the matter, focusing instead on her own ventures. However, sources close to the former couple suggest that the fallout from Thomas’ actions has strained relationships within their shared social circle. Fans of Real Housewives of Atlanta have taken to social media, expressing shock and disappointment, with many citing Thomas’ story as a sobering lesson in financial accountability.

The case also highlights the broader issue of tax compliance among small business owners. According to the IRS, unpaid employment taxes account for billions of dollars in annual revenue losses, often due to mismanagement or deliberate fraud. For entrepreneurs like Thomas, who juggle multiple ventures and complex financial obligations, the temptation to prioritize short-term gains over long-term compliance can be overwhelming—but the consequences are dire.

A Lesson Hard Learned

As Peter Thomas navigates his 18-month sentence, his story serves as a bloody reminder of the importance of financial diligence. Entrepreneurs, regardless of their industry or scale, cannot afford to ignore their tax obligations. Thomas’ journey from reality TV fame to federal prison underscores a universal truth: no one is above the law, and the IRS is a formidable adversary.

For aspiring business owners, Thomas’ downfall offers a clear takeaway: invest in proper accounting, seek expert advice, and never treat tax obligations as an afterthought. As Thomas himself put it, “Don’t be sloppy like I was. Pay your taxes, or you’ll pay a much heavier price.”